What Is a Short Sale?

When you owe more on your home than it’s worth and you need to sell, the transaction in which you will sell your property is called a short sale. You need your lender’s approval to do a short sale because they’ll be accepting less than they’re owed at closing. There are many reasons homeowners opt for a short sale, but one of the most common is to avoid going into foreclosure.

If you’re a buyer, a short sale can enable you to buy a property at a discount because the seller is distressed and has fewer options. But you’ll need to be patient because buying a property in a short sale may take some time. Let’s review more details about how short sales work for sellers and buyers.

How Do Short Sales Work for Sellers?

Short sales are an option for homeowners who are underwater on their mortgage to sell their property, and to avoid going into foreclosure. For many distressed homeowners, short sales are an alternative to foreclosure. Here are the steps sellers need to take in order to sell their properties in short sales:

- Provide proof of hardship: When you owe more than your home will sell for, you can’t just list your home to start. You first need to provide proof of hardship to your lender. The two most accepted hardship cases are proof that lower income has made your home unaffordable, or that you’re subject to a mandatory job relocation. When reviewing your hardship case, your lender will analyze your income and assets. If your debt-to-income ratio has risen, it will help your short sale approval. If you have money saved, they’ll require that you contribute these funds to minimize their loan payoff loss. You will also need to provide a market analysis as well as indicate any liens on your property.

- List your property: Once the lender has approved the short sale, you can list your property with a real estate agent. You’ll need to present any offers to the lender for approval. This process can take two weeks to several months. If you have a second mortgage, both lenders must approve each other’s terms, making the process longer.

- Lenders approve the sale of the property: The lenders will review the buyer’s offer and decide if they will approve the sale. Once approved by the lenders, the short sale can close as soon as the buyer can get their loan approved, funded and closed.

What Happens After Closing for the Seller

Typically, your credit score will drop by 75 to 200 points after selling your property in a short sale, which is less severe than a foreclosure. (Experts estimate that a foreclosure will lead to a dip in your credit score of about 200 or 300 points). Lenders often won’t consider a short sale approval for your property until you’re two to three months behind on your payments. This means your credit score drop will be at the higher end of the range if this is the case. The rest of the drop will depend on whether the lender reports the short sale as “settled” debt or “paid” debt. You should try to negotiate for the latter, but the former is more common, and hits your credit score harder.

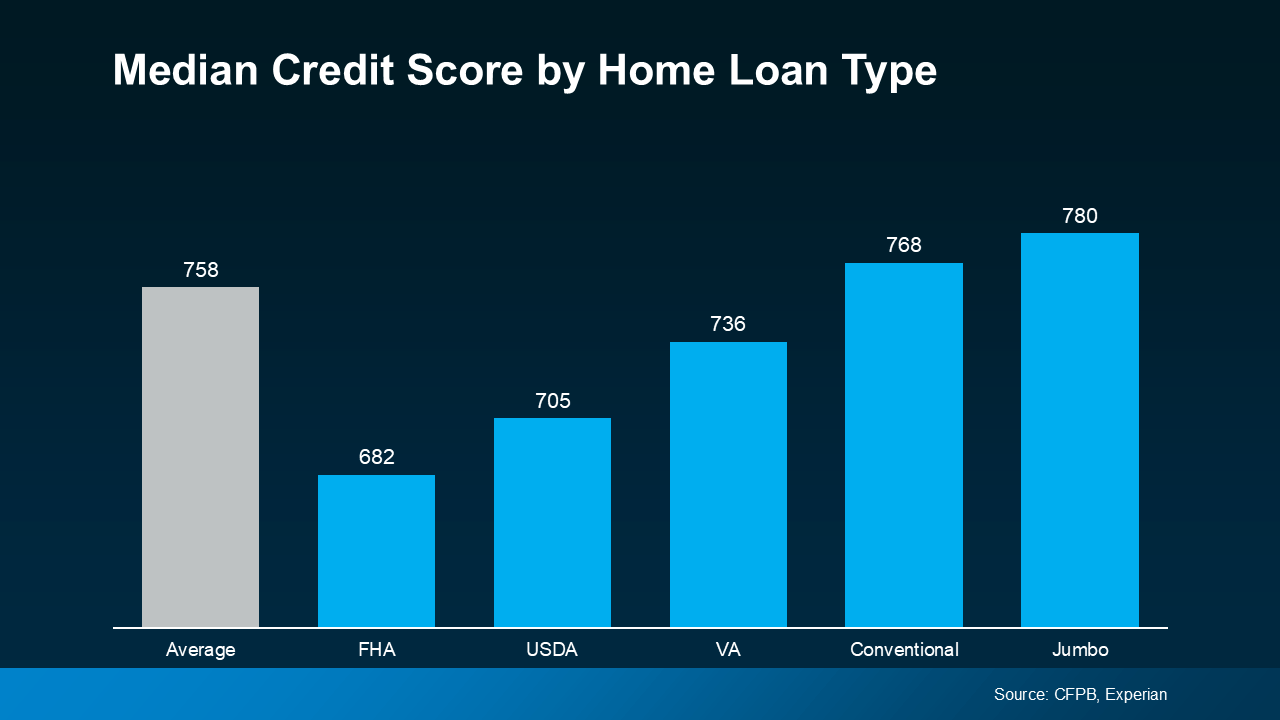

The short sale will stay on your credit report for seven years, but you can finance a new home purchase within one to four years of a short sale depending on credit score, loan type and down payment. Again, a foreclosure is even more severe. With a foreclosure, that time ranges from three to seven years. Ask your lender to advise on options. Prior to the housing crisis, the lender’s loss was taxed as income for the seller, but now short sellers have no tax liability.

Categories

Recent Posts

LEAVE A REPLY